Global energy and the IoT – Part 2

David Parker, senior analystBeecham Research

Distributed generation is forcing changes in the way power grids operate, along with environmental legislation by governments driving incentives to replace fossil fuel power plants with renewable energy.

New supplier-customer scenarios are emerging where a consumer of power can also be a producer via the solar panels on the roof of their home or business. These ‘prosumers’ may also have energy storage ‘beyond the meter’ with an Electric Vehicle (EV) or storage batteries able to consume energy when traditional demand is low.

Germany and Sweden are examples of countries where governments are offering financial support to households investing in battery storage for their solar panels, allowing more efficient use of solar energy, says David Parker, senior analyst, Beecham Research.

In his ‘LinkedIn Influencer Post’ of December 2016, Carlos Ghosn, CEO of the Renault-Nissan Alliance talks about a ‘Disruptive Triangle’ of technologies that promise to ‘improve the quality of life for billions’.

This triangle consists of:

- The electrification of transport (EVs)

- Autonomous drive

- Connectivity (The IoT)

In this scenario, the IoT is an enabler for either partial or total autonomous vehicle operation using mapping systems and payment systems via smart phone apps.

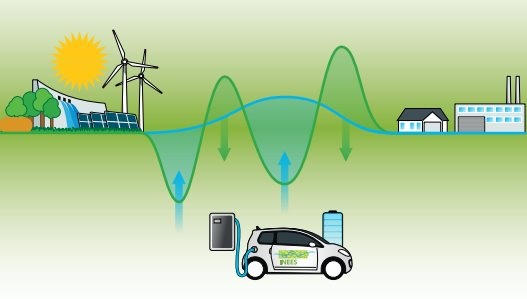

Another disruptive triangle, adjacent to that described by Mr. Ghosn is as follows:

- Renewable Energy

- EVs

- Smart Grids

The use of IoT technologies in the smart grid bridges the Energy and Transport sectors, managing power from intermittent solar and wind energy sources and EVs to store that power when the car is parked up and plugged in.

Global EV sales were 50,000 in 2011 and reached 450,000 in 2015. During 2015 the millionth EV was sold, the two millionth EV will be on the roads in the first half of 2017. This is a tiny proportion of the global population of 1.2 billion cars and vans but recent sales growth is set to continue such that by 2020 industry forecasts a global electric car population in excess of 10 million EVs and plug in hybrid vehicles (PHEVs).

Battery sizes of these vary from 8Kw/h for a PHEV to 60Kw/h for an upscale EV. With an average of 25Kw/h this amounts to 250Gw/h of energy storage, something utility companies are showing an interest in with many V2G (Vehicle to Grid) trials underway.

When not in use EVs and PHEVs are normally plugged in to the electrical supply, a growing store of energy that presents a way of smoothing out supply and demand, an opportunity for utilities to buy cheap power to meet peak demand and sell more of it during off-peak times when incremental costs are low.

In Germany between June 2012 and December 2015, the INEES (Intelligent integration of EVs in the power grid) ran a V2G (Vehicle to Grid) project. This involved the integration of 20 EVs, grid control software and a mobile phone app as a user interface for the car owners.

Although not considered economically viable with this small sample, the principles of balancing electric power using an EV pool was proved to be safe and secure for the power grid, providing a short reaction time to changes in demand. In a world where an increasing number of vehicles are effectively computers and batteries on wheels when stationary, this represents a growing market for the IoT.

Power companies are evolving, albeit slowly, adjusting to these new challenges and opportunities. Deploying smart meters is now a well-trodden path for utilities to understand more about the demand side of their business. It also provides more communication with their customers, allowing them to offer and incentivise power usage at different times of the day.

The world’s demand for energy will continue to grow along with global wealth, a grid connection is an indicator of economic growth and a platform for human development. How we produce and consume energy is changing with a growing trend for off-grid generation in developing regions where no grid power is available. A starter kit of a solar panel and batteries provide enough power for a light bulb and a mobile phone charger.

The former allows for night time study and improving educational results, the latter allows farmers to check market prices for their produce. All these systems require monitoring over telecommunications networks, yet more business for those supplying services to the IoT.

The author of this blog is David Parker, senior analyst, Beecham Research

Comment on this article below or via Twitter @IoTGN