Investment of US$2.6bn in insurtech helps drive fintech boom as companies adapt in ‘Survival of the Fittest’

Miro Parizek of Hampleton Partners

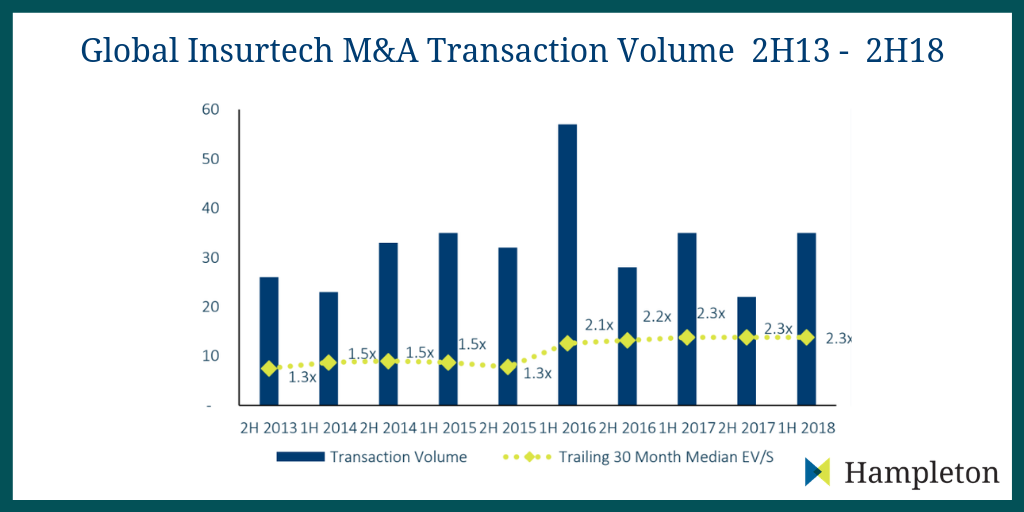

The Insurtech M&A Market Report from international technology mergers and acquisitions advisors, Hampleton Partners, reveals that 2018 global fundraising for insurance technology start-ups has already reached an all-time high in volume with 204 deals and transaction values of $2.6 billion (€2.28 billion), close to the 2015 peak of $2.7 billion (€2.37 billion).

Since 2016 the insurtech sector has reported 151 transactions, with 22 buyers making more than one acquisition. Strategic buyers, such as insurance enterprise software company Sapiens International and Charles Taylor, are in the driving seat with 87% of all transactions, versus private equity’s 13%, says Hampleton.

Miro Parizek, founder, Hampleton Partners, says: “There’s an army of insurtech start-ups which are challenging legacy players and the market has adopted a survival of the fittest environment. Since organic growth and investing in R&D is a long-term game, M&A has been the natural solution to the incumbents’ problem of accelerating technological transformation and evolving their traditional business models for the 21st century.”

One key example of an insurance giant innovating via M&A is Zurich International which bought Bright Box and its AI-first, connected car platform Remoto. Zurich Insurance Group is working with data gathered by its connected car technology to develop personalised auto insurance and services.

Parizek concludes, “Next-generation insurance is having to evolve quickly with new business models and a greater focus on technology innovation. Insurtechs have become a natural threat to incumbents, but also potential valuable partners in this changing landscape. It’s a sector that’s growing rapidly and stands to capture a meaningful share of the value pools within a few years. How quickly incumbents adapt to these inexorable market changes will determine the size of their share in the next generation of the insurance industry.”

Comment on this article below or via Twitter @IoTGN