The economics of NB-IoT and LoRa

Joe Madden of Mobile Experts

What drives the profit or loss for an IoT service? People seem to be very confused about which line item is most important here.Should you worry about which cloud service to choose? Should you subsidise the devices for the end user? Is the cost of spectrum meaningful? Which items matter in network CAPEX and OPEX?

Mobile Experts has completed some ROI calculations that boil these decisions down to some simple conclusions.

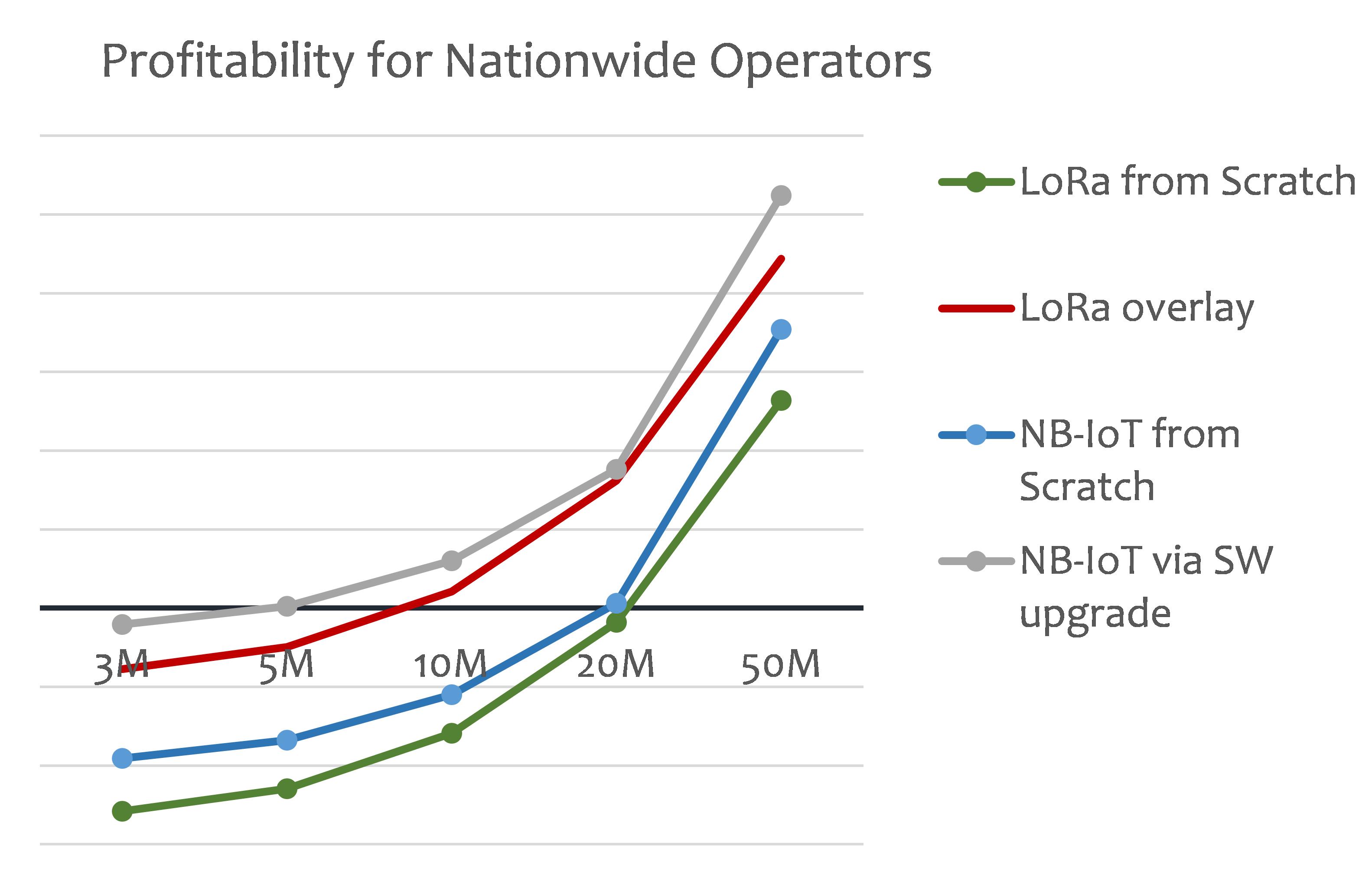

- The choice between NB-IoT and LoRa, for example, is not simple. A NB-IoT network can be deployed inexpensively via software upgrade to an existing LTE network, so that’s clearly the best option if it’s available. If not, then some operators will save network CAPEX if they choose LoRa instead. Others will choose to use NB-IoT based on terrain or other coverage issues. LoRa devices are also cheaper, at least for now.

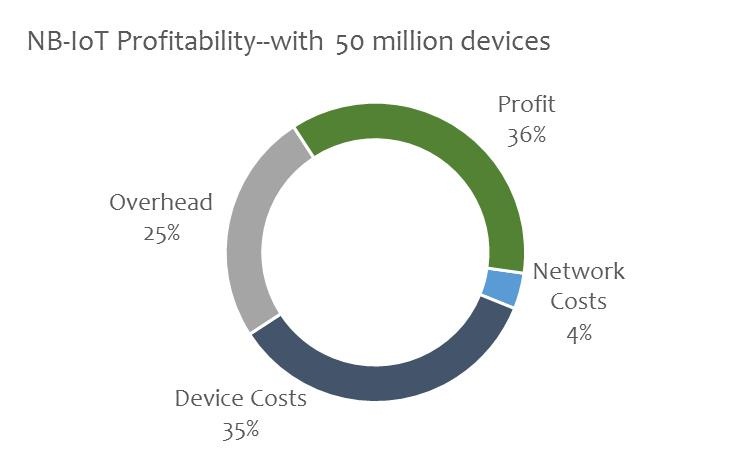

- Choosing between AWS, Google Cloud, and Microsoft Azure is not really a significant factor. In the total cost of ownership equation, the cloud service is a very small percentage of the total.

- Using an existing grid of tower sites can be a huge savings. Nobody wants to pay the lawyers to negotiate for the rights to 20,000 new sites…much easier to add LoRa or NB-IoT to a grid that the existing 2G/3G/LTE network has already established.

- The biggest factor is to decide how to pay for the client devices. If the end user will pay $15-20 (€13.08 – 17.43) for the device, then the business case can work at a reasonable price per month. If the operator needs to give away devices, it’s difficult to make money.

For either LoRa or NB-IoT, deploying a new network is expensive. LoRa needs more sites than NB-IoT, and LoRa operators need to re-invent the nationwide grid with RF planning and site acquisition. NB-IoT base stations can be placed on existing LTE sites but they’re pricey. In either case, the operator will need to reach about 20M devices to simply break even on the investment. Clearly the operators that can deploy an instant NB-IoT network via software upgrade have an advantage here.

Our calculations take total cost of ownership into account, including the CAPEX to deploy a network, the cost of subsidising, provisioning, and managing the devices, the cloud service, and all other operating costs over an 8-year period.

Today, NB-IoT operators in China are complaining that with their network costs and current pricing, they aren’t making money. But I advise them to “hang in there”, as the economics of the IoT market are firmly related to scale, not specific technology choices. Additional devices cost hardly anything for the network, but add more revenue. So, when any large-scale LPWAN reaches 50 million devices, it becomes a healthy business. According to our forecast, they won’t have to wait very long to get there.

The author of this blog is Mobile Experts’ principal analyst, Joe Madden

Comment on this article below or via Twitter @IoTGN